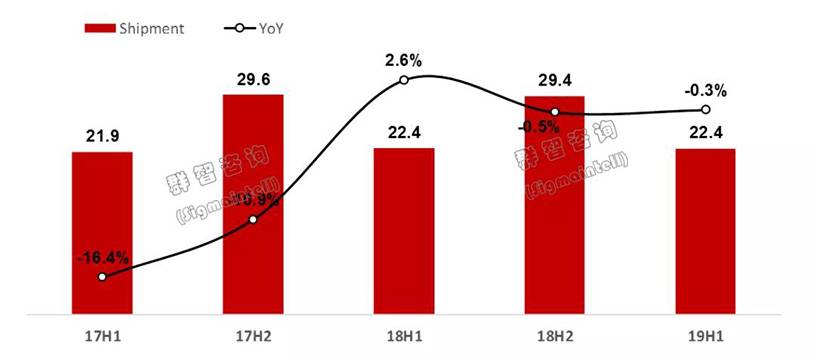

According to the survey data of sigmaintell, in the first half of 2019, the TV shipment volume of China's market was 22.4 million units, down 0.3% year-on-year and 24% month on month. In the second quarter, brands and distributors actively prepared for "6.18", but the retail market performance was unsatisfactory, and TV sales fell, resulting in high inventory of brands and channels. At the same time, due to the influence of trade friction, the promotion of Chinese brands in North America is blocked, which aggravates the operation pressure of some brands.

Semi annual shipment quantity and year-on-year trend of TV sets in China market in 2017-2019 (unit: million sets,%)

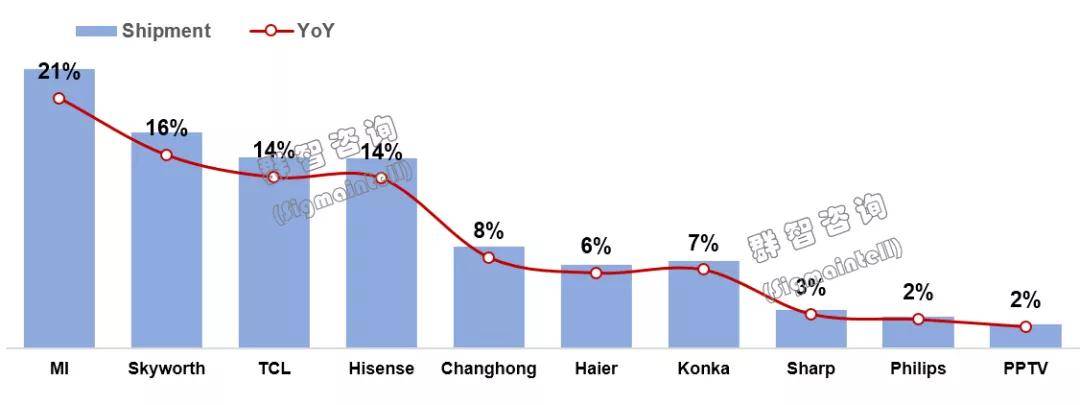

Increase of head brand share

Sigmaintell's analysis on the performance of various brands in the Chinese market is as follows:

In the first half of the year, Xiaomi's shipments reached 4.723 million, ranking first, with a year-on-year growth of 84.5% and a month on month growth of 1.6%. Although China's TV market has entered the stock market in a short period of time, and the demand is difficult to increase substantially, Xiaomi maintains a rapid growth trend with its radical promotion strategy and good brand effect. However, the sales of "6.18" were not as expected, and Xiaomi was faced with a certain degree of de stocking pressure in the third quarter.

In the first half of the year, Skyworth's shipment volume was 3.649 million units, ranking second with a year-on-year increase of 7.8% and a month on month decrease of 20.8%. SKYWORTH relies on the supply chain resources, actively promotes the medium size market, and adopts a positive sales strategy. The sales volume in China market has increased significantly. However, affected by the overall demand downturn, Skyworth's operating pressure increased in the second half of the year.

In the first half of the year, TCL's shipment volume was 3.231 million units, ranking the third with a year-on-year increase of 11.5% and a month on month decrease of 19.6%. In contrast to the strong export demand, TCL's domestic demand was weak in the first half of the year. In recent two years, TCL has been committed to improving its brand image, optimizing its product structure, launching a series of high-end series and improving its profitability.

Hisense's shipment in the first half of the year was 3.21 million units, down 5.1% year on year and 27% month on month. Influenced by competitive brand products and sales strategies, Hisense's shipment performance in the first half of the year was relatively flat. At the same time, the weak domestic demand aggravates the pressure of Hisense. In the second half of the year, Hisense needs to adjust its product layout strategy, actively increase market promotion and relieve the pressure of brand operation.

In the first half of the year, Changhong shipped 1719000 units, down 10.7% year-on-year and 28% month on month. Changhong is lack of growth power in the domestic market, which is greatly affected by the market fluctuations, and the market share has declined.

Haier's shipment in the first half of the year was 1.426 million units, down 19.1% year on year and 46.7% month on month. The TV business strategy has changed from pursuing the growth of scale to maintaining profits, and the market share has dropped significantly.

In the first half of the year, Konka's performance in the domestic market was still relatively weak, with a shipment volume of 1.487 million units, a year-on-year decrease of 21.3% and a month on month decrease of 27%.

For other brands, sharp's shipment in the first half of the year was only 650000 units, down 56.1% year-on-year, with a significant decrease of 49.2% month on month; Philips's shipment in the first half of the year was 550000 units, down 36% year on year, with a decrease of 42.1% month on month; pptv actively carried out low price promotion in the first half of the year, with a shipment of 410000 units, up 128.9% year on year, with a growth of 79.1% month on month.

In the first half of 2019, the shipment ranking of TV sets in China market (unit: m,%)

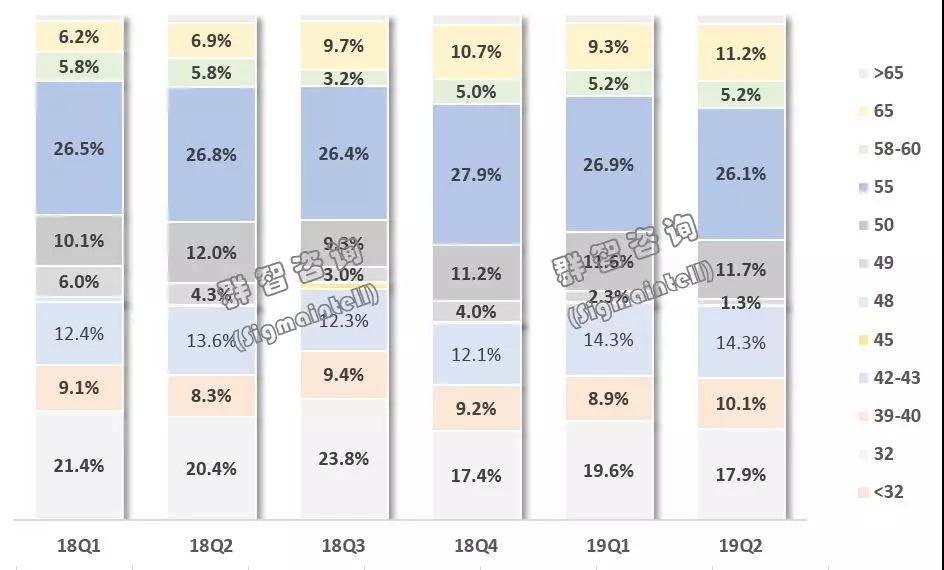

Size structure competition will intensify

Through the analysis, it can be found that the shipment volume of the top five TV brands has occupied 75% of the Chinese market, the market share of the Chinese TV market shows a high trend of gathering the top five brands, and the competitive advantage of the top brands is further enhanced.

In terms of delivery size structure, with the release of g10.5 generation line production capacity, the delivery and market share of 65 "and other large-scale products increased significantly, while 55" as the main size of living room was obviously squeezed by 65 ". In the first half of 2019, 55" for the first time fell in the market share of China for two consecutive quarters. In the future, the competition around the size of living room will be more fierce, and we expect that the market share of 55 "will be further squeezed. In the medium-sized segment, 40 "market share increased significantly in the second quarter, but with the subsequent supply resources of 43" panel becoming more abundant and the price gradually adjusted, it is expected that 43 "market share will accelerate penetration in the future.

18q1 ~ 19q2 China TV size structure trend (unit:%)

In terms of delivery size structure, with the release of g10.5 generation line production capacity, the delivery and market share of 65 "and other large-scale products increased significantly, while 55" as the main size of living room was obviously squeezed by 65 ". In the first half of 2019, 55" for the first time fell in the market share of China for two consecutive quarters. In the future, the competition around the size of living room will be more fierce, and we expect that the market share of 55 "will be further squeezed. In the medium-sized segment, 40 "market share increased significantly in the second quarter, but with the subsequent supply resources of 43" panel becoming more abundant and the price gradually adjusted, it is expected that 43 "market share will accelerate penetration in the future.

Therefore, sigmaintell believes that sales volume is no longer the only standard to test success. It is the right direction for TV brands to constantly enrich product structure, enhance product experience, expand application scenarios, increase product innovation, and enhance consumers' stickiness to TV.